IronVest: A Privacy.com Alternative for Better Card and Bank Account Protection

July 19, 2023

If you’re looking for a privacy.com alternative, you will love IronVest.

IronVest is a security and privacy super app that offers virtual debit and credit cards, also known as masked cards, to protect your real card numbers and banking information. In contrast, privacy.com only masks debit cards and online bank account information.

IronVest is more than just a private payment solution and offers additional features to protect your online accounts and privacy. These include bonus masked services like masked emails and virtual phone numbers, continuous biometric authentication, biometric 2FA protection, and a strong password generator.

To learn more about how IronVest’s masked credit and debit cards compare to privacy.com virtual cards and why IronVest is a superior solution overall, keep reading for a privacy.com vs. IronVest comparison.

In this guide, we look at:

Why Is IronVest a Good Privacy.com Alternative?

IronVest is a leading privacy.com alternative. This is because, like privacy.com, IronVest also offers masked card features. However, whereas privacy.com provides virtual cards for debit cards and online bank accounts only, IronVest also masks credit cards. This makes IronVest not only the best privacy.com alternative but a superior solution.

Privacy.com: Masks debit cards and bank accounts.

IronVest: Masks debit cards, credit cards, and bank accounts.

It’s easy to create virtual debit and credit cards with IronVest, and users get up to unlimited masked cards per month (depending on the chosen plan).

IronVest also offers biometric protection for all accounts and masked cards. Even if a cybercriminal managed to get their hands on your account credentials (IronVest or otherwise) or virtual card numbers, they still could not conduct financial fraud because they could not biometrically prove that they are you. Neither privacy.com nor any other virtual credit card provider offers this safeguard. Totally unique to IronVest in this context, biometric protection is an important feature to help keep your financial information safe.

Better Than Privacy.com

Privacy.com stops at masked cards. IronVest goes further. More than just a privacy virtual payment card provider, IronVest is a security and privacy super app.

With IronVest, you get a comprehensive range of privacy features that make keeping your financial information secure easier than with privacy.com.

Rather than relying on multiple privacy and security services (masked card company, password manager, authenticator, etc.) to secure your finances, with IronVest, everything you need exists in an all-in-one app, including:

Virtual debit and credit cards to stop your actual card numbers from falling into cybercriminal hands.

Masked emails to reduce phishing emails.

Virtual phone numbers to minimize the risk of phone-based attacks like vishing and SIM swapping.

Continuous biometric protection to ensure no one but you can access your bank accounts, use virtual cards, and conduct financial transactions.

Biometric 2FA to stop attackers from intercepting your MFA codes.

Password manager to help you keep your accounts secure.

Masked identity autofill profiles to keep your personal information private.

IronVest is free to get started with - sign up for IronVest today.

Privacy.com vs. IronVest: A Comparison

Feature | Privacy.com | IronVest |

Masked debit cards | Yes | Yes |

Masked credit cards | No | Yes |

Encryption | AES-256 and PBKDF2 password hashing for password | Combination of bank-grade security software, a zero-knowledge decentralized architecture, biometric 2FA protection, and decentralized biometric fraud prevention technology |

2-factor authentication and protection | Yes, but only for your privacy.com account | Yes, for all your online accounts, with 2FA codes routed through IronVest’s virtual security number released upon biometric authentication for extra protection |

Biometric authentication | No | Yes, for all your online accounts |

Autofill | Yes | Yes, and it can be set up to use with biometric authentication |

Cost per virtual card | No fee, funded by connecting your bank account via ACH | No fee when funded by connecting your bank account. $2 per card when using a credit card as a funding source. On cards over $100, there is an additional fee of 1.5%. |

Transaction privacy | Yes | Yes |

Bank support | More than 15,000 banks | Most banks in the US |

Pricing plans | Free Pro ($10 per month) Teams ($25 per month) | Free Plus ($5.95 per month) Ultimate ($14.95 per month) |

Masked emails | No | Yes |

Virtual phone numbers | No | Yes |

Comprehensive privacy features | No, just masked cards | Yes. Full suite of tools including virtual credit and debit cards, masked emails, masked phone numbers, password management features, biometric authentication and 2FA protection, and web tracker blocker |

Company Backgrounds

Privacy.com is a secure payment service founded in 2014 and launched in 2016. The New York-based service offers burner cards to protect your real debit card numbers and bank account information.

IronVest is a holistic security and privacy super app that protects all your online accounts. Besides masked debit and credit cards, the IronVest platform includes masked emails and virtual phone numbers, decentralized infrastructure, biometric authentication and 2FA protection, and password management features like a secure password generator, autofill, and storage.

Established in 2022, IronVest is an enhanced version of the popular Blur by Abine password manager and digital wallet (which was spun out into IronVest). IronVest takes Blur’s market-leading password management software and enhances it with proprietary biometric fraud prevention technology. The combined app has over 3M installs to date.

IronVest is headquartered in New York, USA, and its research and development team is based in Tel Aviv, Israel.

Availability

Privacy.com virtual card services are available to US citizens or legal residents who:

Are 18 years old or older.

Have a US checking account.

Have a US phone number that can receive texts.

Have an identification number (usually SSN).

IronVest is available to US citizens or legal residents who:

Are 18 years old or older.

Have a US credit card.

Card policy and requirements occasionally change - users should check terms and conditions for up-to-date information.

Security

Encryption

Privacy.com uses AES-256 encryption to encrypt data at the application layer, with encryption keys stored in memory. Privacy.com also uses PBKDF2 password hashing for your password, and the hash is salted. Privacy.com is PCI-DSS compliant.

IronVest is protected by a combination of bank-grade security software, a zero-knowledge decentralized architecture, decentralized biometric fraud prevention technology, and biometric 2FA protection. This means any user data is protected, and virtual credit cards can not be fraudulently used by cybercriminals once they are created.

Two-Factor Authentication

Privacy.com allows users to enable 2FA to protect their privacy.com accounts. To do this, users need a 2FA app that supports TOTP, for example, Google Authenticator, Authy, or 1Password.

IronVest gives users the option of protecting their IronVest accounts with two-factor authentication.

The IronVest platform can also improve the security of your other online accounts that are protected with text-based MFA.

IronVest protects text-based MFA against SIM-swap attacks by routing your MFA code through IronVest’s own secure virtual phone number and automatically filling it out on your behalf. IronVest users can also enable biometric authentication, meaning that 2FA codes are only auto-filled after your identity is confirmed via biometrics.

Biometric authentication

Privacy.com does not offer biometric authentication and protection options.

IronVest uses the same biometric fraud prevention technology it sells to banks to protect consumers and their financial accounts. Users can enable biometric protection for their IronVest account, masked debit and credit cards, and other online accounts.

IronVest account. With biometric authentication enabled, it’s virtually impossible for someone that is not you to access your IronVest account and steal your information.

Masked card numbers. Even if someone were able to access your virtual card numbers, they still could not use them because, when activated, IronVest biometric protection requires face biometric authentication before using the cards.

Other online accounts. You may not always be able to use masked cards, but that doesn’t mean your security has to suffer. By enabling IronVest’s biometric protection on important accounts (bank, pension, stocks, crypto, etc.), you can prevent bad actors from committing financial fraud.

IronVest's biometric security doesn’t just verify your identity at login, either. It continues to verify you during sensitive actions after login to ensure that any transactions made are made by you and you only.

Due to IronVest’s use of decentralized and zero-knowledge infrastructure, no one (not the company or anyone else) can access your biometric or other personal data.

Pricing

Privacy.com has three different plans:

Personal plans are free.

Pro plans are $10 per month.

Teams’ plans are $25 per month.

Under the free option, users can create up to 12 new privacy cards per calendar month, but they must be funded by connecting your bank account via ACH.

With the Pro plan, users get up to 36 new cards per month and 1% cash back on purchases, the option to mask transaction information on bank statements, and priority support.

The Team plan lets users create up to 60 new cards per month and everything in the Pro plan, plus dedicated account management.

IronVest also has three different plans (which include account protection, masked emails, virtual phone number, and more):

Free plans do not require a credit card and are free to use.

IronVest Plus plans are $5.95 a month or $39 a year.

IronVest Ultimate plans are $14.95 a month or $99 a year.

New IronVest users can try the IronVest Plus plan for free for 30 days. Start your free 30-day trial today.

With IronVest’s Free plan, users can try masked credit cards for free for 30 days as part of the Plus plan trial. In addition, Free users also get 3 customized masked email addresses, real or masked identity autofill profiles, password management features, secure notes, secure credit card storage and autofill, website anti-tracking, and support.

Under the IronVest Plus plan, users get everything in the Free plan, plus up to 35 virtual cards per month, up to 50 customized email addresses, IronVest virtual phone number, biometric account protection, 2FA passcode protection, seamless syncing between devices, and priority support. For virtual cards, using a credit card as a funding source incurs a fee of $2 per card. On cards over $100, there is an additional fee of 1.5%.

With the IronVest Ultimate plan, you get everything in the Plus plan, as well as unlimited virtual cards, 2 no-fee virtual credit cards per month, and unlimited masked emails. IronVest also supports credit card funding, which protects your physical credit card from fraud.

Free plans

Privacy.com has a free plan that comes with 12 new cards per month. These cards can be one-time use or locked to a specific merchant, and users can set spend limits (per transaction, monthly/annual basis, or total) on each card as well as pause and close them. The free plan includes access to the privacy.com web app, browser extension, and mobile app.

IronVest has a free plan, which comes with a 30-day free trial to the IronVest Plus plan. As a result, free users can try virtual cards for 30 days. The Free plan also includes 3 customized masked email addresses, real or masked identity autofill profiles, secure credit card storage and autofill, password management features, secure notes, web anti-tracking, and support.

Masked Cards

Card Types

Privacy.com is compatible with debit cards and checking accounts. It does not support credit cards.

IronVest is compatible with credit cards, debit cards, and bank accounts.

Purchases

Privacy.com users can use cards with merchants that accept Mastercard or Visa cards. Privacy virtual cards also work with international merchants if they accept US debit or credit cards.

IronVest masked cards can be used to make online purchases with US merchants, including Amazon, Netflix, Walmart, Spotify, and more.

Autofill

Privacy.com users can generate and autofill secure card numbers via the Privacy browser extension, which is available on Chrome and Firefox.

IronVest lets you generate and autofill masked cards on the go through its browser extension (available on most browsers) and mobile app. This means that if you create a virtual card on a desktop and want to use it while on mobile, you can do so seamlessly since masked cards are synced along with the rest of your data.

IronVest can also automatically fill in your physical card details, passwords, and real or masked identity profile information like name, phone number (including masked phone number - more on this below), address, and email address. This makes online shopping and signing up for online accounts easier and quicker.

Other information IronVest can fill out on your behalf includes preferred username, date of birth, website URL, gender, Social Security number, Driver’s License, company name, and company position.

For extra protection, you can set up IronVest to only autofill this information after biometric authentication.

Merchant ID

Privacy.com can shield your transaction information from your bank. By default, when you make an online payment with a privacy card, the information that appears on your bank account is “Privacy.com,” followed by the company you purchased from. However, you can also set the merchant information to anonymous, such as just “privacy.com.”

IronVest can hide your transactions from your bank. If you use IronVest’s masked cards, the merchant ID that will show up on your bank account statement will be “IronVest.”

Cost

Privacy.com cards are free of charge. Privacy.com charges merchants a small transaction fee every time a customer uses a privacy card which typically goes to debit card providers like MasterCard and Visa.

IronVest masked cards have a fee of $2 per card for cards under $100. For cards above $100, there’s a charge of 1.5% of the card value. IronVest doesn’t make any money from these fees - the company is just passing along the fees they are charged to be able to provide this service.

Alternatively, paid users can use their bank account (currently a beta service option) to make money transfers to their masked cards, in which case, they are not charged any fees for creating masked cards.

Banks

Privacy.com covers more than 15,000 banks.

IronVest supports most banks in the US.

Refunds

Privacy.com users that get a refund from a merchant they used a masked card with will see the refund go back to the original funding source.

IronVest users will get a refund back to their masked card, and they can have the balance refunded back to them.

Cashback

Privacy.com offers Pro users 1% cashback on their purchases (on transactions eligible for this and with a limit of $4,500).

IronVest does not provide cashback.

Additional Features

Masked emails

Privacy.com does not provide a masked email option.

IronVest lets users mask their emails. This means you can hide your email address with a randomly generated one like m8wn6mg6ql000@opayq.com or one that looks real but isn’t john@opayq.com.

Masked emails are an important privacy measure. Why? Because even though masked cards can protect your bank account number and card information, cybercriminals can still scam you if they can find out your email address (which can happen if a website you did business with suffers a data breach, for example).

Phishing emails, where hackers trick people into handing over their credit card or bank account details and/or credentials, are regrettably common and result in countless Americans losing money every year.

Besides scams, masked emails also help you reduce the amount of spam you receive from e-commerce sites and other websites. When you share your email address with a website, that website is more than likely going to do two things:

Send you marketing emails.

Share your email with third parties (which is how your personal data can end up on data broker sites and in the hands of other marketers and even scammers).

When you use a masked email address, the website you shared it with won’t see your real email address.

The emails from a specific website or service you’ve used the masked email for will be forwarded to your real email. All the emails you send using a masked email address will also look like they’ve come from your masked email address rather than your actual email. You can turn off forwarding at any time in the IronVest dashboard.

You can keep track of all the masked emails you’ve used and where you’ve used them via the IronVest dashboard. If you don’t want to get emails from a particular sender anymore, you can toggle off forwarding or delete the masked email completely.

Masked phone numbers

Privacy.com does not have a masked phone number feature.

IronVest users can mask their phone numbers with a masked phone number, also known as a virtual phone number.

A masked phone number can replace your real phone number when filling out online forms or even in real life. The masked phone number will forward calls, texts, and voicemails to your real phone number, and you can also make calls from your masked phone number.

If you don’t want to get any more calls from a specific number, you can switch off forwarding via the IronVest dashboard, which also shows you all the virtual phone numbers you’ve used and with whom. If you turn off forwarding, the person calling your masked number will be told that the number they called is no longer available.

Your IronVest virtual phone number also acts as your 2FA security code phone number. When you authenticate yourself online through 2FA, your code is routed through this masked phone number and is only released when the IronVest platform authenticates you biometrically.

Password management

Privacy.com does not offer any password management features.

IronVest provides advanced password management features like a strong password generator, password importing, password autofill, and password strength report.

You can set up IronVest to autofill your passwords for bank accounts and other important accounts upon biometric authentication only. Uniquely, IronVest authenticates you both at the time of login and throughout your entire online session to prevent post-login attacks.

This adds ultimate security to your bank and credit card accounts by ensuring that no one but you can access your financial information or make financial transactions.

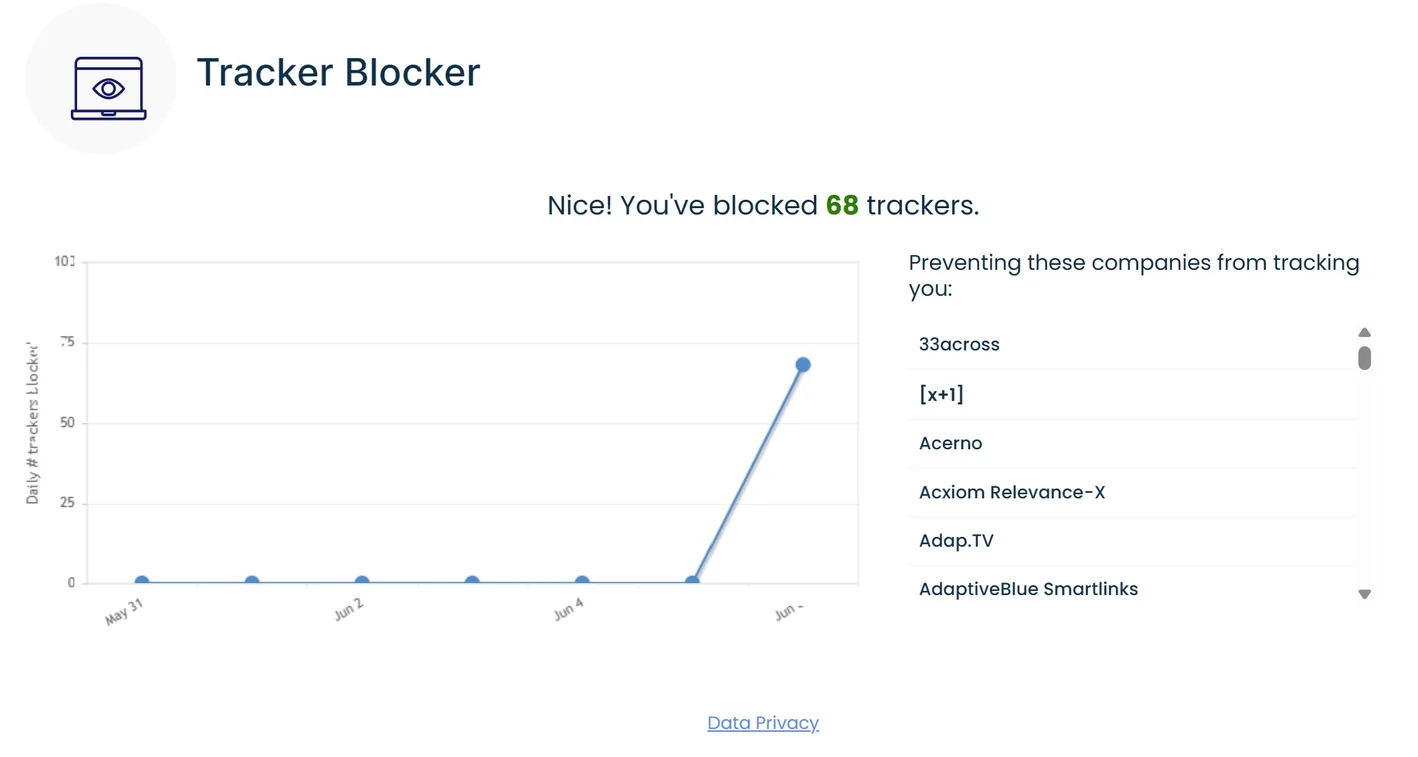

Web Tracking Blocker

Privacy.com does not block web trackers.

IronVest has a web tracking blocker that stops sites from using hidden trackers to spy on your activity as you browse the internet.

Web Browser Extensions

Privacy.com provides a browser extension for Google Chrome and Firefox.

IronVest has a browser extension for most common web browsers.

Mobile App

Privacy.com has a mobile app for iOS and Android.

IronVest has Android and iOS mobile apps which sync across desktop seamlessly.

Customer Support

Privacy.com has a knowledge base where they explain how to use their virtual debit cards. Users that have issues with virtual card numbers can also contact customer support via email and Twitter. Paid users receive priority support.

IronVest provides a knowledge base and help center with common questions and answers, plus tutorials on how to set up and use your IronVest account. Users can also get help via email, and Plus and Ultimate users can contact customer support in real-time through live chat.

Privacy Policies

Privacy.com’s privacy policy is user-friendly and lists the kind of information they collect, how the company manages this data, and your choices in how it’s managed.

Privacy.com lists whom it shares your data with (third parties who need it to perform functions on the company’s behalf, with government or law enforcement where necessary, etc.) and notes that it may also share anonymized/aggregated information that doesn’t identify you.

If you delete your account, Privacy.com may retain your personal information for a period of time consistent with any applicable laws.

IronVest has an easy-to-read privacy policy that describes in simple language the data it collects about you and why.

IronVest is very clear about its data-sharing practices. It lists all its partners, what type of data it shares with them, and for what reasons.

IronVest is also transparent about its data retention policies. It will retain your data for as long as you’re a customer, three years after you close your account, or as required by applicable laws or business operations.

IronVest says it permanently destroys customer biometric data once the initial purpose of this information is met or three years after you last interact with the company.

Privacy.com vs. IronVest: Which Is Better?

Privacy.com is a good option for people who are only looking for a virtual card service.

However, if you want to ensure your financial information is secure, you should look at what other solutions are available as well. In this case, IronVest, with a ton of additional privacy and security features like biometric authentication, masked emails, virtual phone numbers, and advanced password management, is a far superior solution.

IronVest: A More Comprehensive Privacy.com Alternative

Financial fraud doesn’t just happen when someone steals your card or bank account details. It can also occur through phishing, password guessing, SIM swap, and similar attacks.

For this reason, you need more than masked cards to ensure your finances are secure.

You need comprehensive account protection that encompasses masked features (cards, email addresses, and phone numbers), continuous biometric authentication, and password management. You need a security and privacy super app.

That’s what IronVest is.

With IronVest, it’s not just your card and bank numbers that are secure. It’s all your online accounts, whether that’s banking, cryptocurrency, social media, or something else entirely.

Sign up for IronVest today for free.